Lawyers and accountants will have experienced firsthand the pain of manually validating every single VAT number in the EU VAT Information Exchange System (VIES). It sounds like a little step in a big process but if not performed diligently, it can cost businesses thousands or in some cases even millions of funds in irrecoverable VAT so it’s pretty important to get this right.

The problem

“We have hundreds of VAT numbers that we need to verify weekly and checking every single number manually is not only very unexciting but it’s also hugely time-consuming. The biggest problem is that after a few dozens of checks, the attention to detail starts to escape and that increases the scope for errors and slows down the process even further.”

The Solution

A robot picks up all VAT numbers that need to be validated, performs a check against the VIES platform using an API, creates a report showing you exactly which VAT numbers were validated and which were not, and emails you the findings.

How it works? ... in 4 Simple Steps

1. Robot asks you to provide the file containing all VAT numbers

To start the process all you need to do is provide the robot with the file that contains all the VAT numbers you need to verify. This could be in any format and it could contain numerous columns. The robot will identify the column with the VAT numbers and will use only that information for the next steps.

2. Robot picks up the VAT numbers and performs a VIES check

The robot picks up all VAT numbers, and using an API connection, it checks if the VAT numbers can be found on the VIES database.

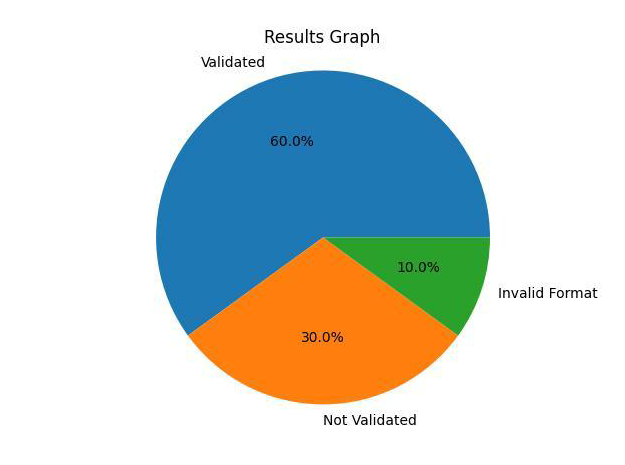

3. Robot prepares a PDF report with the results

After the check is complete, the robot calculates the % of VAT numbers that were successfully validated, the % of those that were not validated, and the % of those that had an invalid format. It presents this visually too in a little graph.

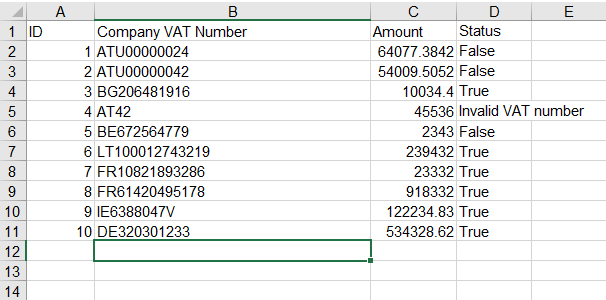

The robot also prepares an Excel table showing the status of each VAT number check, indicating that the number is one of the following: Validated, Not Validated, Invalid Format.

That way, all you have to do is investigate the exceptions.

4. Robot sends you an email with the results

To complete the process, the robot sends you all results directly via email so you don’t have to wonder when it’s finished. Job done!!

Why bother automate your VIES Check?

Save time

A robot is able to verify the VAT numbers in seconds and provide a clear analysis showing all VAT numbers that were successfully validated and those that failed, meaning all you have to do is investigate the exceptions.

Reduce error

Focusing on a manual task for hours is tiring and boring so the scope for error is huge. A robot doesn't get tired and works with 100% accuracy to validate all VAT numbers in a few seconds or minutes.

Smarter Operations

The robot works in the background so you can easily continue doing other value-adding work whilst the robot does the checking. That way you do the valuable job whilst the robot handles the admin.

Ready to automate your VIES check?

Let's talk about your VIES check process and see how we can automate it best 🙂